Holland Ma Excise Tax . welcome to the town of holland’s online payment center! You have two (2) options for paying your bill; if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. the motor vehicle tax rate is currently $25.00 per $1,000 valuation. Here you will find helpful resources to property and various excise taxes administered by the. view the property and tax information website, bs&a online. Here you can look up information regarding property taxes,. A taxpayer must pay an excise for any calendar year in. calculation of the excise amount. The amount of the motor vehicle excise due on any particular vehicle or trailer in any. 27 sturbridge road, holland, ma 01521. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. massachusetts property and excise taxes.

from www.studocu.com

The amount of the motor vehicle excise due on any particular vehicle or trailer in any. Here you can look up information regarding property taxes,. view the property and tax information website, bs&a online. massachusetts property and excise taxes. welcome to the town of holland’s online payment center! the motor vehicle tax rate is currently $25.00 per $1,000 valuation. You have two (2) options for paying your bill; calculation of the excise amount. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. Here you will find helpful resources to property and various excise taxes administered by the.

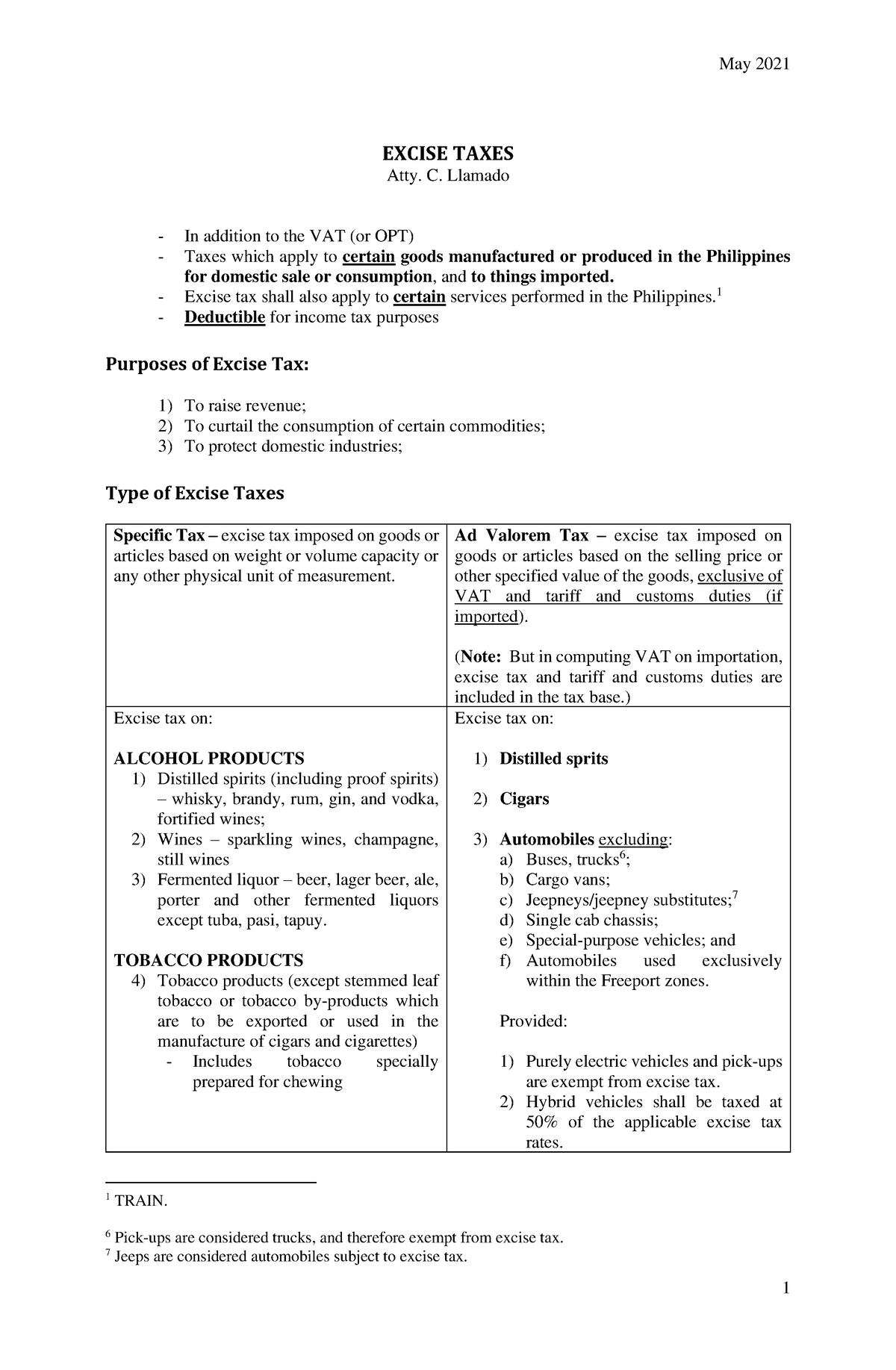

CPAR Excise Tax, DST (Batch 89) Handout EXCISE TAXES Atty. C. Llamado

Holland Ma Excise Tax massachusetts property and excise taxes. You have two (2) options for paying your bill; 27 sturbridge road, holland, ma 01521. massachusetts property and excise taxes. view the property and tax information website, bs&a online. if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. Here you will find helpful resources to property and various excise taxes administered by the. The amount of the motor vehicle excise due on any particular vehicle or trailer in any. the motor vehicle tax rate is currently $25.00 per $1,000 valuation. welcome to the town of holland’s online payment center! A taxpayer must pay an excise for any calendar year in. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. Here you can look up information regarding property taxes,. calculation of the excise amount.

From sean.edubit.vn

LÝ THUYẾT MẬT MÃ HOLLAND Holland Ma Excise Tax Here you will find helpful resources to property and various excise taxes administered by the. the motor vehicle tax rate is currently $25.00 per $1,000 valuation. calculation of the excise amount. Here you can look up information regarding property taxes,. if you own a registered motor vehicle or trailer, you have to pay a tax, called a. Holland Ma Excise Tax.

From www.studocu.com

Excise TAX Introduction to Transfer Taxation EXCISE TAX Reference Holland Ma Excise Tax You have two (2) options for paying your bill; calculation of the excise amount. massachusetts property and excise taxes. The amount of the motor vehicle excise due on any particular vehicle or trailer in any. Here you will find helpful resources to property and various excise taxes administered by the. Here you can look up information regarding property. Holland Ma Excise Tax.

From entwksymesy.blogspot.com

past due excise tax ma Yuk Colwell Holland Ma Excise Tax Here you can look up information regarding property taxes,. The amount of the motor vehicle excise due on any particular vehicle or trailer in any. if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. A taxpayer must pay an excise for any calendar year in. You. Holland Ma Excise Tax.

From blog.taxexcise.com

The deadline for efile form 2290 is just around the corner! Efile Holland Ma Excise Tax Here you can look up information regarding property taxes,. calculation of the excise amount. if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. the motor vehicle tax rate is currently $25.00 per $1,000 valuation. Here you will find helpful resources to property and various. Holland Ma Excise Tax.

From alphasuretybonds.com

MA Excise Tax Alcoholic Beverage Bond Ensuring Compliance and Holland Ma Excise Tax calculation of the excise amount. the motor vehicle tax rate is currently $25.00 per $1,000 valuation. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. welcome to the town of holland’s online payment center! Here you will find helpful resources to property and. Holland Ma Excise Tax.

From www.vedderprice.com

Excise Tax on Corporate Stock Repurchases Under the Inflation Reduction Holland Ma Excise Tax massachusetts property and excise taxes. Here you will find helpful resources to property and various excise taxes administered by the. 27 sturbridge road, holland, ma 01521. You have two (2) options for paying your bill; The amount of the motor vehicle excise due on any particular vehicle or trailer in any. Here you can look up information regarding property. Holland Ma Excise Tax.

From www.signnow.com

Ma 355s 20202024 Form Fill Out and Sign Printable PDF Template Holland Ma Excise Tax Here you can look up information regarding property taxes,. You have two (2) options for paying your bill; Here you will find helpful resources to property and various excise taxes administered by the. welcome to the town of holland’s online payment center! view the property and tax information website, bs&a online. it is the responsibility of the. Holland Ma Excise Tax.

From www.wwlp.com

A guide to your annual motor vehicle excise tax WWLP Holland Ma Excise Tax the motor vehicle tax rate is currently $25.00 per $1,000 valuation. massachusetts property and excise taxes. 27 sturbridge road, holland, ma 01521. Here you can look up information regarding property taxes,. view the property and tax information website, bs&a online. it is the responsibility of the tax collector to make sure every real estate, personal property. Holland Ma Excise Tax.

From sanjaytaxprozzz.blogspot.com

Pay My Past Due Excise Tax Massachusetts Holland Ma Excise Tax it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. massachusetts property and excise taxes. 27 sturbridge road, holland, ma 01521. The amount of the motor vehicle excise due on any particular vehicle or trailer in any. the motor vehicle tax rate is currently $25.00. Holland Ma Excise Tax.

From www.holbrookma.gov

Boat Excise Holbrook MA Holland Ma Excise Tax You have two (2) options for paying your bill; if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. 27 sturbridge road, holland, ma 01521. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax. Holland Ma Excise Tax.

From www.ebay.com

Original 1947 Wayland, MA Excise Tax Receipt for 1936 Pierce Arrow Holland Ma Excise Tax The amount of the motor vehicle excise due on any particular vehicle or trailer in any. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. Here you will find helpful resources to property and various excise taxes administered by the. calculation of the excise amount.. Holland Ma Excise Tax.

From blog.taxexcise.com

What’s new in the Federal Excise Tax Form 720? IRS Holland Ma Excise Tax if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. Here you will find helpful resources to property and various excise taxes administered by the. The amount of the motor vehicle excise due on any particular vehicle or trailer in any. You have two (2) options for. Holland Ma Excise Tax.

From www.studocu.com

CPAR Excise Tax, DST (Batch 89) Handout EXCISE TAXES Atty. C. Llamado Holland Ma Excise Tax Here you will find helpful resources to property and various excise taxes administered by the. if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax. Holland Ma Excise Tax.

From www.researchgate.net

Holland Beer excise taxes in ten towns 16501805 (guilders) Download Holland Ma Excise Tax A taxpayer must pay an excise for any calendar year in. it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. 27 sturbridge road,. Holland Ma Excise Tax.

From www.ebay.com

Original 1948 Wayland, MA Excise Tax Receipt for 1936 Pierce Arrow Holland Ma Excise Tax if you own a registered motor vehicle or trailer, you have to pay a tax, called a motor vehicle and trailer excise,. the motor vehicle tax rate is currently $25.00 per $1,000 valuation. Here you will find helpful resources to property and various excise taxes administered by the. 27 sturbridge road, holland, ma 01521. Here you can look. Holland Ma Excise Tax.

From quizlet.com

Explain the welfare effects of an excise tax. Quizlet Holland Ma Excise Tax You have two (2) options for paying your bill; the motor vehicle tax rate is currently $25.00 per $1,000 valuation. Here you can look up information regarding property taxes,. view the property and tax information website, bs&a online. 27 sturbridge road, holland, ma 01521. Here you will find helpful resources to property and various excise taxes administered by. Holland Ma Excise Tax.

From taxfoundation.org

How Much Does Your State Collect in Excise Taxes? Tax Foundation Holland Ma Excise Tax You have two (2) options for paying your bill; calculation of the excise amount. welcome to the town of holland’s online payment center! the motor vehicle tax rate is currently $25.00 per $1,000 valuation. view the property and tax information website, bs&a online. it is the responsibility of the tax collector to make sure every. Holland Ma Excise Tax.

From blog.taxexcise.com

Advantages of Prefiling Form 2290 on Holland Ma Excise Tax welcome to the town of holland’s online payment center! it is the responsibility of the tax collector to make sure every real estate, personal property and motor vehicle excise tax bill. calculation of the excise amount. the motor vehicle tax rate is currently $25.00 per $1,000 valuation. The amount of the motor vehicle excise due on. Holland Ma Excise Tax.